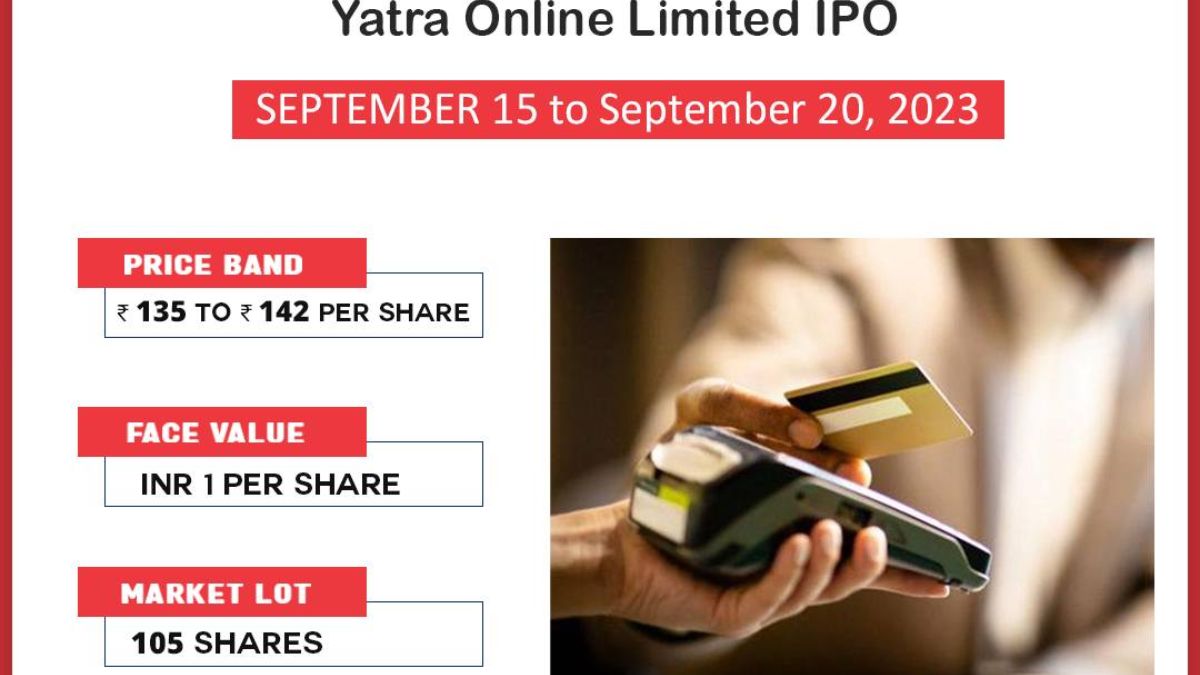

Yatra Online IPO: Yatra Online IPO opens for public subscription on Friday, September 15, 2023 and will close on Wednesday, September 20, 2023. The bidding for anchor investors concluded on Thursday, wherein the company collected Rs 348.75 crore. The price band for its public issue at Rs 135-142 per equity share of face value Rs 1 each. At the upper end of the price band, the company’s promoters and shareholders seek to raise Rs 775 crore from the IPO.

The IPO comprises a fresh issue of 42,394,366 shares aggregating up to Rs 602 crore and an offer-for-sale (OFS), with promoters offloading 12,183,099 shares aggregating up to Rs 173 crore. The lot size of the Yatra Online IPO is 105 shares. The company intends to use the net proceeds from the IPO for strategic investments, acquisitions, and inorganic growth, investments in customer acquisition and retention, technology, and other organic growth initiatives, and general corporate purposes.

Should you apply for the Yatra Online IPO?

Stoxbox: Subscribe

“Yatra Online is well-positioned to capture a significant share of growth in the tourism industry in India, owing to its longstanding relationship with both B2B and B2C customers. This enables the company to target India’s most frequent and high-spending travellers and educated urban consumers. With the growth in the tourism industry, we expect the online travel market share (OTA) to increase faster than captive players, improving the company’s profitability. With the company posting profits in FY23 and strong revenue growth in the past, we remain positive on the company from a medium to long-term perspective. We, therefore, recommend an SUBSCRIBE rating for the issue.”

Anand Rathi: Subscribe – long Term

“At an upper band, the company is valued at P/E of 219x while on market- cap/sales it is valued at 5.8x post issue of equity shares, compare to its peer (Easy trip planners – 15.7x) on FY23 basis. Therefore, we believe that for Yatra there is a scope of business improvement on the back of industry tailwinds, brand recall and business scalability, resulting in expansion of EBITDA margin from here on. Thus, we recommend an “SUBSCRIBE – long term” rating to the IPO.”

(The recommendations in this story are by the respective research analysts and brokerage firms. FinancialExpress.com does not bear any responsibility for their investment advice. Capital markets investments are subject to rules and regulations. Please consult your investment advisor before investing.)