By Achin Goel

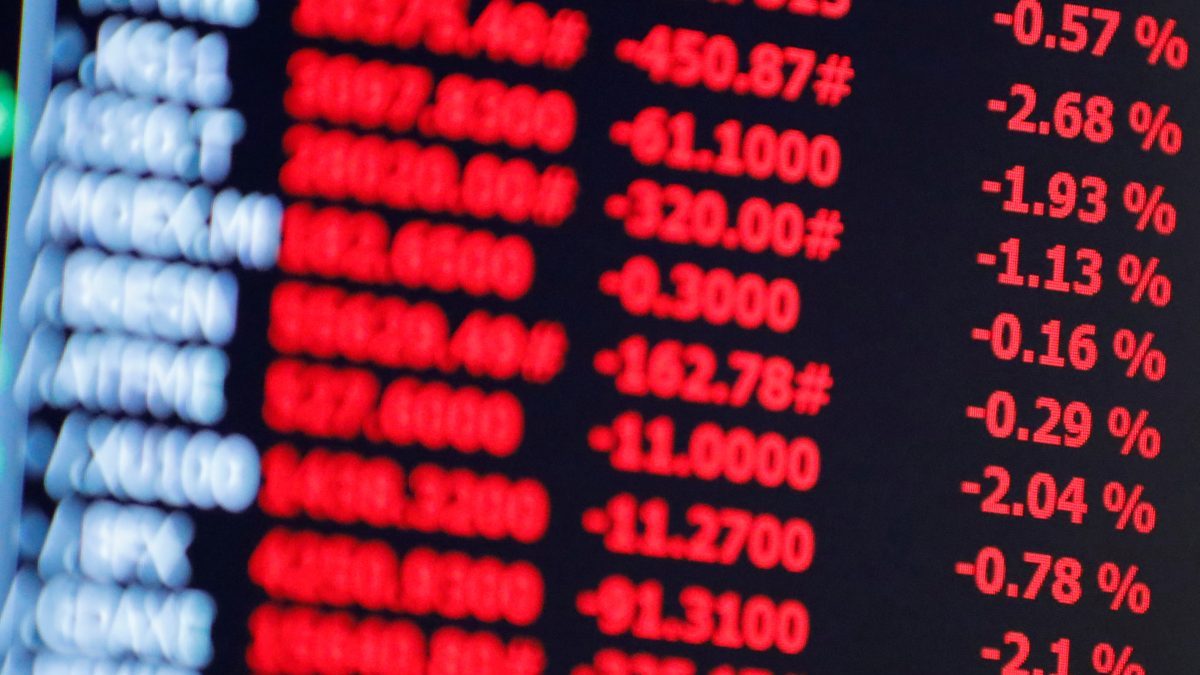

The Indian stock market has been one the outperforming capital markets globally and many economists concur that India will be a bastion of growth for the global economy in the near and medium term. However, bouts of volatility induced by global factors affect Global Indices and the Indian stock market, of which, we shall discuss a few:

The US Stock Market

The US stock market is one of the most important markets in the world, and its performance has an impact on other markets, including the Indian stock market. Why? 1) The US is India’s largest trading partner, therefore, the performance of the US economy has a domino effect on the Indian economy as well and with fear of a recession looming over the US economy Indian markets are bound to witness some volatility; 2) Many Indian companies are listed on US stock exchanges and many US companies have operations in the India, this makes a strong correlation between both the countries; 3) the US dollar is the most important currency in the world which is directly tied with strength of the US economy, and so the DXY can have an impact on the Indian rupee as discussed earlier.

From Feb-20 to Mar-20, when the COVID-19 pandemic caused a global lockdown, the Dow Jones Industrial Average (DJIA) fell by over ~35%, the NIFTY 50 during the same period fell by ~33%. In 2021, when the global economy began to recover NIFTY 50 also gained ~24%, while DJIA climbed ~19%.

Crude Oil Basket

Crude oil is a major input for many Indian industries, and crude oil prices are a major determinant of the cost of transportation, manufacturing, and other key sectors of the Indian economy. When the price of oil rises, it can have a negative impact on the Indian stock market. Higher oil prices can make it more expensive for Indian companies who import raw materials and squeeze their profit margin. Nevertheless, the impact of the oil basket on the Indian stock market is not always straightforward – if the price of crude oil climbs due to a supply shortage, it could lead to higher inflation, which can hurt consumer spending and corporate earnings. However, if the price of crude oil rises due to strong demand, it could boost economic growth and consequently the stock market. Hence it is important to keep a vigilant eye on the oil price. When the Russia – Ukraine conflict began in early 2022, crude oil prices went above $140 / barrel, which led to a correction of the Indian equity market by ~12% over the next 6 months. However, as crude oil prices stabilized and have gone below the price when the conflict started, NIFTY 50 started going up and is currently at an all-time high.

Freightos Baltic Index (FBX)

FBX is the leading international Freight Rate Index, in cooperation with the Baltic Exchange. During 2022 freight rates were elevated for the first half due to shortage of freight containers. This adversely impacted export oriented stocks since they were unable to deliver their products on time which upset their working capital and profitability. In addition to these, there are other factors that can affect the Indian stock market, such as – US Federal Interest Rate Cycle, International government policies & agreements and much more.

In conclusion, investors should carefully monitor global economic and financial conditions along with prominent global indices, as the Indian stock market is intricately intertwined with the global economy and when global market indices are strong, the Indian stock market tends to do well except for any domestic predicament.

(Achin Goel- Vice President Bonanza Portfolio. Views expressed are the author’s own. Please consult your financial advisor before investing)